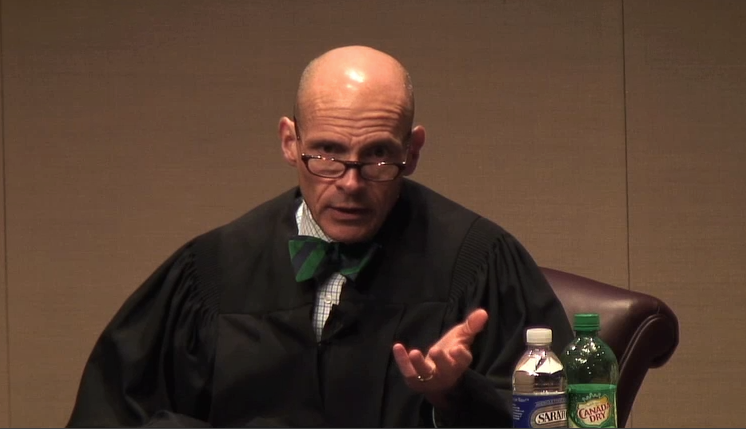

According to a Press statement released on March 22 2017 by the Department of Justice,U.S. Attorney’s Office District of Maryland ,Ogundele was also convicted of aggravated identity theft in connection with the scheme. Judge Grimm ordered that Mojisola Popoola’s supervised release is to be served in home detention. Judge Grimm also ordered Ogundele to forfeit $2,195,103.36, and ordered Mojisola Popoola to forfeit approximately $165,000 and to pay restitution of $34,100.

On March 20, 2017, Judge Grimm sentenced Moji Popoola’s brother, Babatunde Emmanuel Popoola, a/k/a “Emmanuel Popoola” and “Tunde Popoola, age 34, of Bowie, Maryland, to 12 years in prison, on the same charges. Judge Grimm ordered Babatunde Popoola to pay restitution of $465,170.76. Ogundele and the Popoolas were convicted on November 18, 2016, after a 17-day trial.

According to the statement,In a related case, Funmilayo Joyce Shodeke, age 67, of Burtonsville, Maryland, pleaded guilty on March 22, 2017 to conducting an unlicensed money transmitting business, and was sentenced to 13 months’ probation, and ordered to forfeit $29,900.

The sentences were announced by United States Attorney for the District of Maryland Rod J. Rosenstein and Special Agent in Charge Gordon B. Johnson of the Federal Bureau of Investigation.

According to the evidence presented at trial, and co-conspirators’ plea agreements, from January 2011 to May 18, 2015, members of the conspiracy searched online dating websites to initiate romantic relationships with vulnerable male and female individuals. They phoned, emailed, texted and used internet chat messenger services to form romantic relationships with the victims, who lived in Maryland and around the country.

According to the statement, members of the conspiracy used false stories and promises to convince the victims to provide money to the conspirators, including fake hospital bills, plane trips to visit the victims, problems with overseas businesses and foreign taxes. Ogundele, the Popoolas, co-conspirators Olusegun Charles Ogunseye, Olufemi Wilfred Williams, Adeyinka Olubunmi Awolaja and others opened bank accounts, called “drop accounts,” in order to receive millions of dollars from the victims. The victims provided money to the defendants as a result of the false stories and promises, either depositing money directly into drop accounts controlled by the defendants, or by checks sent to the conspirators. The payments from victims ranged from $1,720 to $50,000. Ogundele, Babatunde Popoola, and others used victims’ names, bank account numbers or driver’s licenses in furtherance of the fraud scheme.

Ogundele, the Popoolas, Ogunseye, Williams, Awolaja and their co-conspirators dispersed money received from the victims by transferring funds to other accounts controlled by the conspirators, by obtaining cashier’s checks, and by writing checks to individuals or entities, in order to conceal the nature, source, and control of those assets.

According to the statement,Co-conspirator Victor Oyewumi Oloyede, age 42, of Laurel, Maryland, was also convicted at trial for his role in the fraud scheme. Oloyede was sentenced to 234 months in prison.

Co-conspirators Olusegun Charles Ogunseye, age 59 of Laurel, Maryland, Olufemi Wilfred Williams, age 28, of Owings Mills, Maryland, and Adeyinka Olubunmi Awolaja, Jr., age 34, of New Carollton, Maryland, each pleaded guilty to conspiracy to commit money laundering. Judge Grimm scheduled sentencing for Awolaja on June 12, 2017, for Ogunseye on July 25, 2017, and for Williams on July 27, 2017, all at 2:30 p.m.

According to the statement, The Maryland Identity Theft Working Group has been working since 2006 to foster cooperation among local, state, federal, and institutional fraud investigators and to promote effective prosecution of identity theft schemes by both state and federal prosecutors. This case, as well as other cases brought by members of the Working Group, demonstrates the commitment of law enforcement agencies to work with financial institutions and businesses to address identity fraud, identify those who compromise personal identity information, and protect citizens from identity theft.

This recent announcement is part of the efforts undertaken in connection with the President’s Financial Fraud Enforcement Task Force. The task force was established to wage an aggressive, coordinated and proactive effort to investigate and prosecute financial crimes. With more than 20 federal agencies, 94 U.S. attorneys’ offices, and state and local partners, it’s the broadest coalition of law enforcement, investigatory and regulatory agencies ever assembled to combat fraud. Since its formation, the task force has made great strides in facilitating increased investigation and prosecution of financial crimes; enhancing coordination and cooperation among federal, state and local authorities; addressing discrimination in the len

According to the statement, United States Attorney Rod J. Rosenstein commended the FBI for its work in the investigation and thanked Assistant U.S. Attorney Thomas P. Windom, who is prosecuting the case.